Description

There is no greater legacy than inspiring endless possibilities

Securing the future of your loved ones is one of the greatest gifts that anyone can bestow. By creating a priceless legacy for them, you can ensure that your family will be well provided for, today and tomorrow. Although life is filled with uncertainties, we can help ensure that your legacy will not only be protected but will also be enhanced – through Great 110 Legacy.

Providing added protection against the unexpected, the plan is specially designed to endow you with extra benefits for a greater future. With Great 110 Legacy, you can confidently embrace all of life’s possibilities with a legacy that lets you go further towards realising your dreams.

-

Key BenefitsDouble protection against death or TPD

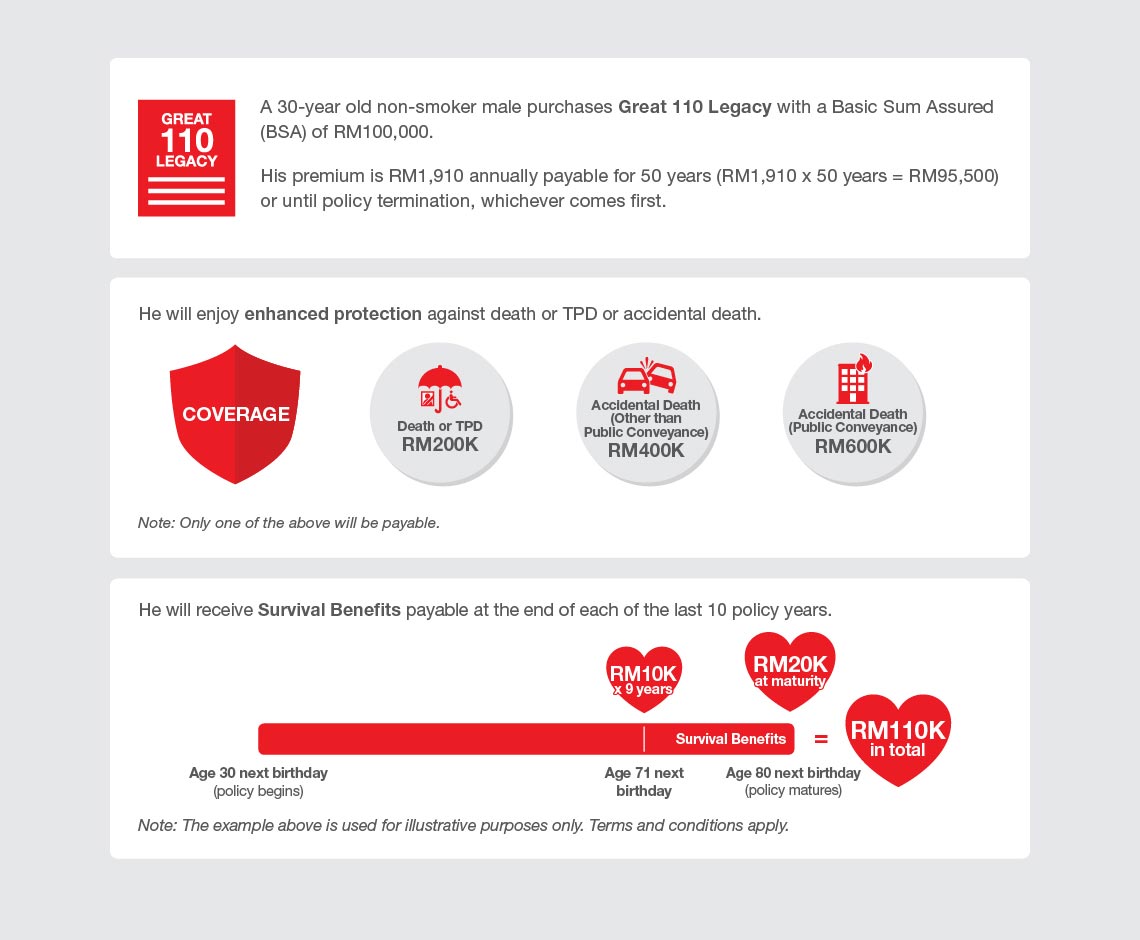

Upon death or TPD, the plan pays out in one lump sum the higher of 200% of the BSA1 or total premiums paid2 , as per the provisions of the policy3 .

Up to 4 times Basic Sum Assured for accidental death

A substantial Accidental Death Benefit will be payable upon accident death prior to policy anniversary of the attained age 70 years next birthday3 .

Guaranteed Survival Benefits

Guaranteed Survival Benefits will be payable at the end of each of the last 10 policy years, until death or surrender of the policy4, 3 .

Enhanced protection with optional riders

You can enjoy greater peace of mind by attaching these riders to your Great 110 Legacy plan3 .

-

Footnotes1 Basic Sum Assured.

2 Including health loading (if any) without interest.

3 Terms and conditions apply.

4 Whichever occurs first. -

DisclaimerGreat 110 Legacy is a non-participating endowment plan that matures at age 80 years next birthday or 30 policy years, whichever is later. Premiums are payable until maturity of the plan, or upon policy termination, whichever occurs first. Any increase in coverage shall entail an increase in premium payment. However, the premium rates are guaranteed and remain the same throughout the premium payment term.

You should satisfy yourself that these plans will best serve your needs and that the premium payable under the policy is an amount you can afford. A free-look period of 15 days is given for you to review the suitability of the plan. If the policy is returned to the Company during this period, the full premium will be refunded to the policy owner minus the expenses incurred for medical examination, if any. If you switch your policy from one company to another or if you exchange your current policy with another policy within the same company, you may be required to submit an application where the acceptance of your proposal will be subject to the terms and conditions to be imposed at the time of policy switching or replacement.

The policy may not have a guaranteed minimum cash value on termination until after you have paid premiums for two years. If you surrender your policy early, you may get back less than the amount you have paid. If you stop paying premiums before the end of the premium payment term, an automatic premium loan will be effected under your policy to pay future premiums so long as the cash value is more than the total indebtedness. The Company shall charge interest on the above loans at interest rates to be determined by the Company from time to time. The prevailing interest rate is available on the Company’s official website. Cessation of premium payment before the end of the premium payment term may lead to early termination of coverage.

The above is for general information only. It is not a contract of insurance. You are advised to refer to the Sales Illustration, Product Disclosure Sheet and sample policy documents for detailed important features and benefits of the plan before purchasing the plan. The exclusions and limitations of benefits highlighted above are not exhaustive. For further information, reference shall be made to the terms and conditions specified in the policy issued by Great Eastern Life.

The terms “Great Eastern Life” and “the Company” shall refer to Great Eastern Life Assurance (Malaysia) Berhad.

Information correct as on 5 June 2018.

How Great 110 Legacy works

Footnotes and disclaimers

Please do take note of the below to ensure you fully understand what this product does and does not cover. If in doubt, contact your Great Eastern Life Planning Advisor or have us call you back.